The Chart Trader

Here you will discover everything you need to know about Forex trading, Forex education and Forex market research using modern Elliot wave counting, wave analyses, chart patterns and trending analysis.

About Us

Consistency across multiple time-periods. We begin with quarterly data and progress down in time through monthly, weekly, daily and hourly data.

Consistency across multiple asset classes.

Durable, accurate, and actionable through multiple complete market cycle Based upon the facts we know, as given to us by the markets themselves. As a direct consequence, guessing, hope, fear, and greed are eliminated.

By integrating our analysis into their decision-making framework, market participants can validate or challenge existing convictions to achieve their goal of maximizing risk-adjusted returns.

What We Do

Research and analyse the Markets: Forex, Stocks, Futures, Commodities and Cryptocurrency.

Major Macro Markets: S&P, US 10Y, EUR$, $JPY, Crude Oil, Gold… ie “the pulse” of the market

Forex, Equities, Commodities, Stocks

BLOCKCHAIN: Bitcoin, Ethereum, Ripple and other Crypto currencies.

Visit the course page to see a video of these forecast in action : click here

TCT FORECAST !!

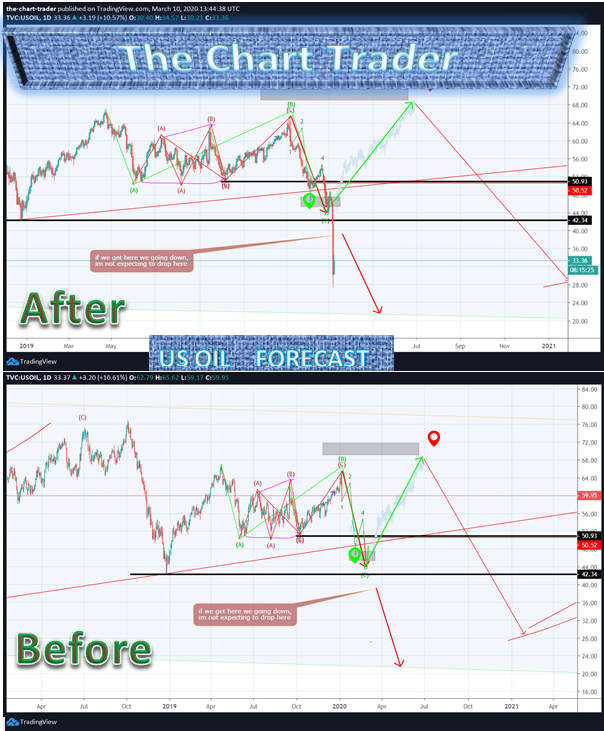

Here some of The Chart Trader previous forecast, thats what to expect when joining us

Watch how we predicted the market movement with 90% accuracy

Why people lose money in trading Forex?

A commonly known fact is that most Forex traders fail. In fact, it is estimated that 95 percent of Forex traders lose money and end up quitting. To help you make it into that elusive 5 percent of winning traders, below some of the most common reasons why Forex traders lose money:

Befriending the Market

The market is not something you beat, but something you understand and join when a trend is defined. At the same time, the market is something that can shake you out if you are trying to get too much from it with too little capital. Having the “beating the market” mindset often causes traders to trade too aggressively or go against trends, which is a sure recipe for disaster.

Low Start-Up Capital

Most currency traders start out looking for a way to get out of debt or to make easy money. It is common for Forex marketers to encourage you to trade large lot sizes and trade using high leverage to generate large returns on a small amount of initial capital.

You must have some money to make some money, and it is possible for you to generate outstanding returns on limited capital in the short term. However, with only a small amount of capital and outsizes risk because of too-high leverage, you will find yourself being emotional with each swing of the market’s ups and downs and jumping in and out at the worst times possible.

You know!!

You can resolve this issue by never trading with a too-small amount of capital. This is a difficult problem to get around for someone that wants to start trading on a shoestring. $5,000 is a reasonable amount to start off with if you trade very small (micro lots or smaller). Otherwise, you are just setting yourself up for potential disaster.

Failure to Manage Risk

Risk management is key to survival as a Forex trader as in life. You can be a very skilled trader and still be wiped out! by poor risk management. Your number one job is not to make a profit, but rather to protect what you have. As your capital gets depleted, your ability to make a profit is lost.

You should!!

To counteract this threat and implement good risk management, place stop-loss orders and move them once you have a reasonable profit. Use lot sizes that are reasonable compared to your account capital. Most of all, if a trade no longer makes sense, get out of it.

Giving in to Greed

Some traders feel that they need to squeeze every last pip out of a move in the market. There is money to be made in the forex markets every day. Trying to grab every last pip before a currency pair turns can cause you to hold positions too long and set you up to lose the profitable trade that you are trading.

The solution!!

seems obvious here, just don’t be greedy. It’s fine to shoot for a reasonable profit but there are plenty of pips to go around. Currencies continue to move every day so there is no need to get that last pip; the next opportunity is right around the corner.

Indecisive Trading

Sometimes you might find yourself suffering from trading remorse. This happens when a trade that you open isn’t immediately profitable and you start saying to yourself that you picked the wrong direction. Then you close your trade and reverse it, only to see the market go back in the initial direction that you chose.

how to conquer this ??

In this case, you need to pick a direction and stick with it. All that switching back and forth will just make you continually lose little bits of your account at a time until your investing capital is depleted.

Trying to Pick Tops or Bottoms

Many new traders try to pick turning points in currency pairs. They will place a trade on a pair, and as it keeps going in the wrong direction, they continue to add to their position being sure that it is about to turn around this time. If you trade this way, in the end, you end up with much more exposure than you planned, along with a terribly negative trade.

It’s best to trade with the trend. It’s not worth the bragging rights to know that you picked one bottom correctly out of 10 attempts. If you think the trend is going to change, and you want to take a trade in the new possible direction, wait for a confirmation on the trend change.

What should you do!!

If you want to pick up a position at the bottom, pick up the bottom in an uptrend, not in a downtrend. If you want to open a position at the top, pick a top when the market’s making a corrective move higher, not an uptrend that’s part of a larger a downtrend.

Refusing to Be Wrong

Some trades just don’t work out. It is human nature to want to be right, but sometimes you just aren’t. As a trader, you just have to accept that you’re wrong sometimes and move on, instead of clinging to the idea of being right and ending up with a zero-balance trading account.

It is a difficult thing to do, but sometimes you just have to admit that you made a mistake. Either you entered the trade for the wrong reasons, or it just didn’t work out the way you planned it. Either way,

What can i do??

The best thing to do is just admit the mistake, dump the trade, and move on to the next opportunity.

Buying a System

There are many so-called Forex trading systems for sale on the internet. Some traders are out there looking for the ever-elusive 100-percent accurate Forex trading system. They keep buying systems and trying them until finally giving up, deciding that there is no way to win.

What is Forex trading?

As a new trader! you must accept that there is no such thing as a free lunch. Winning at Forex trading takes work just like anything else.

You can find success by Learning the right way. find a course from someone SUCCESSFUL with high accuracy in forecasting the Forex market. Someone willing to help you building your own method, strategy and trading plan. Instead of buying worthless systems on the internet from less-than-reputable marketers.

WANT TO MASTER EVERY MARKET TURN?

We have tested a lot of methods and came to the conclusion that, to make consistent profits you will need to master Elliott wave, wave analysis and trend analyses combined together with Fibonacci.

And the good News is that we can help you master all of this in very short time, The Chart Trader team has developed a course that will change your future & fast-track you knowledge it will take your trading skills to the next level.. course is now open for a limited time,

DISCLAIMER: The information contained on our website is intended for educational and illustrative purpose only and does not constitute investment advice. Do not make any investment decisions or other decisions bases on the material presented, We cannot be held responsible for your trading results.